Life doesn’t always go well; that also applies to your bookkeeping and accounting meaning that you end up in a mess. Not only does this mean that you are in danger of missing a deadline and incurring fines or penalties, without up to date accounting information you have no control over your business. Have you made a profit? Who owes you money? Who do you owe money to? How much do you owe in tax? How much can you take out of the business to live on? The answers to all of these questions would be found in your accounting. Without the record keeping being up to date you’re operating blind; your business is out of control which is a very stressful place to be.

If you do find yourself in this position the best advice is to take immediate action to get things back on track. Realistically you have two choices; get back on track yourself or pay an accountant or bookkeeper to undertake the work needed to get you back on track. Whichever solution you decide to go for it’s worthwhile knowing what needs to be done to fix the mess.

Getting your record keeping and accounting back on track involves a two pronged approach involving two tasks. The task of starting as you mean to go on will run alongside the larger, and more dreaded, task of tackling the mess. Both of these tasks will happen at the same time with the latter eventually petering out as the backlog is addressed and eliminated.

Start as you mean to go on

The only way that your accounting will be up to date is by getting organised and the place to start with this is by doing three very simple things:

- Get an accounting system

- Open a bank account dedicated to business transactions only

- Link your business bank account to your accounting system via bank feeds which will bring in your accounting transactions automatically

How to do your accounting is covered in more detail in the chapter on “doing the books”. Getting things set up may seem like a faff but in reality it doesn’t take long and ensures that things do not get into a mess. So, setting aside a small amount of time to make sure that you nail your accounting going forward really is the best approach. It’s the right thing to do if you want to be in control of your finances for the business, tax owed and how much you can extract from the business to live on.

It makes sense to make getting set up the right way the first thing on your tackling the mess action plan.

Once you’ve got your system and a business bank account the next step is to follow “The Routine” of regular, monthly and annual tasks set out in the doing the books chapter. Keeping on top of the routine will prevent the mess building up further.

After this you’re ready to move onto the tackling the mess task.

Tackling the mess

There is no bookkeeping fairy who will waive a magic wand and make the mess disappear with the transactions re-appearing in a very neat and tidy system where everything is coded, complete and balanced. In reality there’s no avoiding the mess – the catch up just needs to be done.

If you try to tackle the backlog of unrecorded transactions, the mess, in one go it will be overwhelming; you’ll simply never get started on it. The mess needs to be broken down into a number of smaller parts which can be addressed over a period of time. What is that period of time? Well it is as long as it takes and the time needed will very much depend on how much mess you have to clear up.

The important thing to focus on is that if the backlog is not tackled now it will just get bigger. In reality it’s just a case of having a plan, getting started and making inroads into the backlog which will become smaller every day.

Treat tackling the mess like a project – a set of tasks that need to be carried out over a defined period of time to achieve a specific outcome. Once the project is done things return to normal and any time that you’ve needed to free up to complete the tasks can be released back into your normal routine of things.

Mess Timespan

Before you dive into the catch up action plan it is important to establish the mess timespan. The date from when you started getting your finances back on track becomes the end date for the mess. The start date is the last time you did any bookkeeping which in all likelihood will be the date of the end of the last accounting period for which the accounts were filed or the date that you started your business if it is new. Make a note of the dates and list out the calendar months in this time period.

Catching Up

At the beginning of the catch up it will feel like that’s a mountain to climb to get everything cleared but as you progress through doing a bit at a time the backlog will reduce and you’ll soon be able to see the light at the end of the tunnel when the mess will be gone. You will need to allocate some time to the task of clearing the backlog. In the short term this may mean taking time away from something else, getting up earlier or going to bed later. The time has to come from somewhere. The important thing is to be realistic about how much time a day or week you can allocate to the catching up. Make it achievable as there is nothing worse than failing simply because you couldn’t free up as much time as you thought. Once you’ve established how much time you can realistically allocate to catching up the next thing is to start working through the catch up tasks.

The Mess Pile

The first task will be to collate everything into a pile so that you can see what the size of the mess really is.

Clear some space in your home office, or a spare room and find a big box to pile everything into to start with. This could be a virtual box if you use an online storage system. You will need to search through your paperwork or online records for all bank statements, receipts, invoices, till receipts, credit card statements or any other financial documents that you may have. If you have been using both a business bank account as well as a personal account then you will need the statements from all accounts and credit cards so that you can search for anything that is business related.

Monthly Piles

Having collated everything into an organised pile, the next step is to sort the documents into calendar months covering the timespan of your mess. This is likely to take a significant amount of dedicated time, as well as space for the monthly piles to be set out in (filing trays, folders or boxes appropriately labelled up can help here).

Missing Mess

As you go through this process identify any missing documentation, such as missing bank statements, credit card bills, invoices or receipts. Action will need to be taken to replace any missing documentation by for example contacting the bank or credit card company. The way to tackle the missing mess is to make a to do list of the actions needed to replace any missing documentation and set dates by which these to do tasks need to be completed. Again, it may take a significant amount of time to plug the missing gaps not least if you have to contact banks and credit card companies to obtain documents to ensure the monthly pile contains the paperwork to support all transactions for that time period.

Getting Organised

Each complete monthly mess pile needs to be collated into an order which means recording it in some way. By far the simplest way to achieve this is by entering everything into a spreadsheet.

There would need to be a receipts worksheet and payments worksheet for each business bank account, credit card or other account such as PayPal. The sheet would contain a date, description, amount and analysis columns. All payments out of and receipts into the bank account would be recorded and analysed, although it is only necessary to analyse payments to a few headings such as in the example or those which suit your business.

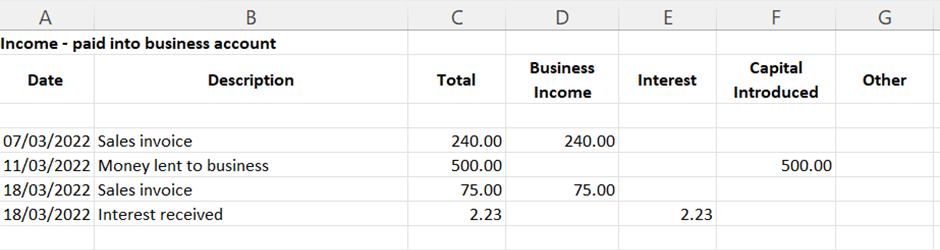

For receipts the sheet would look someone like this:

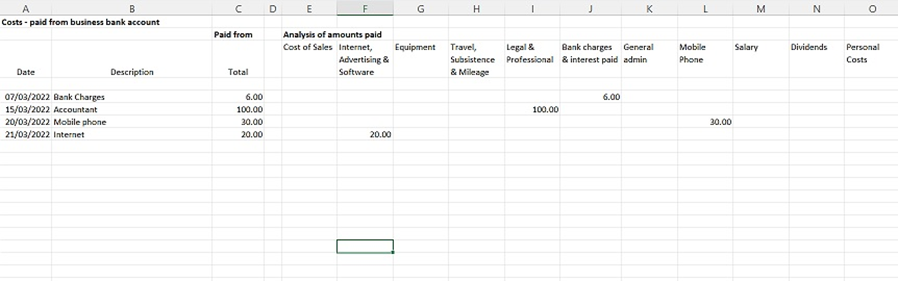

For payments it would look something like this:

In addition there would need to be a receipts worksheet and payments worksheet for any amounts paid or received into or out of personal funds (i.e. not through the business bank account).

Work through a month at a time from the mess pile and add it into the worksheet. Avoid making a worksheet for each separate month as this creates another levels of collation (adding the totals together) which is simply not necessary at this stage. Having all the transactions listed in date order (use the sort function in the spreadsheet if necessary) means that they can be split and posted up as needed into the relevant accounting year if you are more than one year behind on your accounting. The key is to not overthink the collation of the transactions or get too fancy with your worksheets. Keep it simple and capture all of your transactions. Remember this is a catch up exercise and not a process that you will be adopting for your ongoing accounting. However this whole process does rely on you to capture everything correctly. No doubt you will soon realise how much easier it is to keep things up to date as you go!

Try and tackle a month of the mess every couple of days or even every week. It will be a slow process but soon you will break the back of the mess pile and get all of your accounting transactions recorded as they should be.

Merging the results

Once that’s all done the catch up needs to be merged with the information in your accounting system. The transactions do need to be split by accounting year. The simplest way to merge things is by posting up a journal and this is where you may need an accountant to help. You can avoid posting up the detailed transactions into your accounting system as long as you keep the catch up worksheets as back up to support the journals posted into the system.

Time versus Cost

Obviously the execution of the catch up plan will sound like a lot of work and effort but it needs to be done. One way or another you just have to do it or the alternative is paying someone else to do it. Obviously the more that you do yourself the less your accountant’s or bookkeeper’s fees will be. But if you simply do not have the time or inclination to address the mess then you will have to find the funds to pay someone else to help you with this one off project. If you do appoint someone else to help sort out your mess the thing to remember is that they will need your paperwork. Therefore at the very least you will need to get the “mess” together including plugging any gaps of missing documentation.

When engaging someone it is vital to make sure that you tell them exactly what you need them to do using the above as a template for the services that you require. The key is that you get your finances on track going forward so that any financial outlay is just for sorting out the mess and not an ongoing charge. The end result should be that your accounting is all caught up and merged into your new system by accounting year. This means that any accounts and tax returns can easily be filed and you will be in control of your business finances.