Accounting and tax is a complicated fact of life that just has to be done. Knowing the rules is always a good place to start to make sure you do what you need to and avoid wasting your valuable time on unnecessary tasks.

Here’s our top tips about your sole trader self assessment.

Accounts

Did you know that there’s no obligation for a sole trader to produce a set of accounts? You do need to keep accounting records but actually summarising the records into a formal set of accounts (profit and loss account plus a balance sheet) simply isn’t necessary.

So unless you want to have a set of accounts then you can take this task off your to do list.

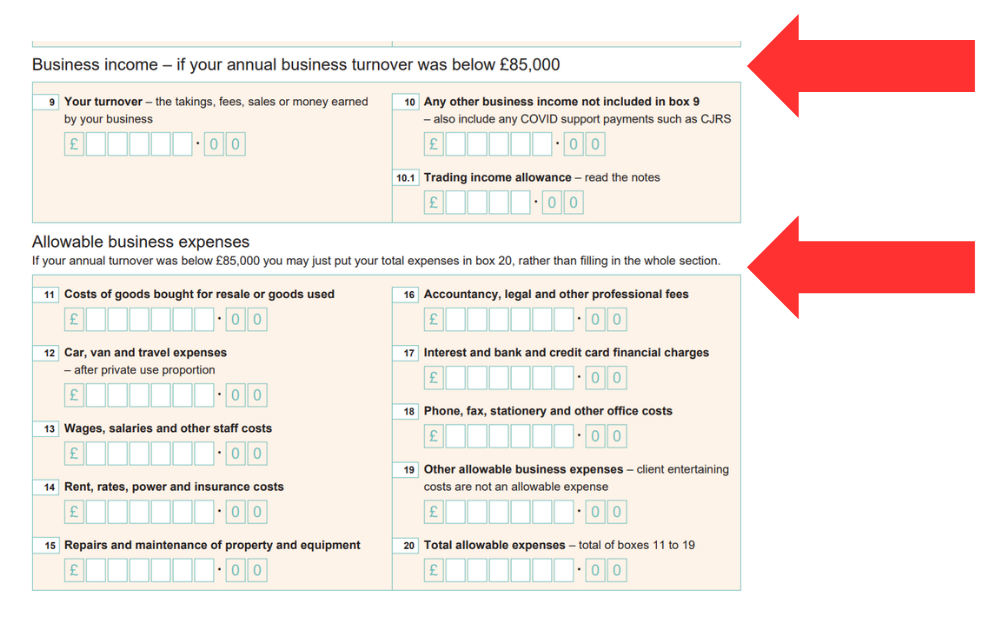

Only two entries on your self assessment

If your turnover (AKA income or sales) is less than £85,000 you only need to complete two figures on the self assessment tax return – total income and total costs.

In fact for qualifying sole trader businesses you only need to complete the self assessment self employed short version – known as the SA103S form.

Your profit (income less costs) will be calculated automatically.

Two figures – that’s how easy it is!

Avoid unnecessary cost analysis

Again for sole trader businesses under £85,000 turnover, there are no rules around how or if you have to analyse your costs, expenses and outgoings. In fact you don’t have to analyse them at all. So unless the analysis would serve you some purpose don’t do it – it’s a waste of time. As we said above you only have to put the total costs on your self assessment tax return.

Of course you do have to make sure that all costs are incurred wholly and exclusively for business purposes.

Trading Allowance

If you have a very small amount of income (gross annual income of £1,000 or less) from all of your self employed businesses you do not have to complete a self assessment tax return.

The formality of this is via claiming the Trading Allowance although there is actually no need to make a claim or tell HMRC.

Simplified Expenses

HMRC do allow you to simplify certain aspects of cost recording by employing the rules related to Simplified Expenses. These rules mean that you can use flat rates for certain costs rather than recording the exact amounts spent. The intention is to make your bookkeeping (record keeping) easier.

These three areas covered by Simplified Expenses and the rules are not compulsory – just use them if it suits you:

- business costs for most cars (except those designed for commercial use), goods vehicles and motorbikes

- working from home

- living in your business premises

Tax due and time to pay

The thing about your profit is that not all of it belongs to you – you will owe HMRC some tax. So you can’t take all of it out the business to live on.

If you’ve ever been employed then you will know that you would have received your pay via the PAYE (pay as you earn) scheme of taxation meaning that all necessary deductions for tax were made before the net was paid over to you.

That doesn’t happen when you are self employed (unless you operate under the Construction Industry Scheme CIS ).

A self employed person is responsible for their tax which in reality means setting aside an amount from the profits as they go throughout the year so that there’s no shocks when the tax bill arrives.

Any good accounting system will give an estimate of the tax due based upon the figures that you have entered into the system. Of course the accuracy of the estimate does demand two things of you:

- That you actually use an accounting system

- You keep the entries up to date in the system

If you are struggling to pay your tax bill then read ….

Also useful to read:

Payments on Account

When you file your first tax return you may get a bit of a shock when you see your tax calculation … it could be higher than expected. This is because a Payment On Account may have been added. HMRC uses the payments on account system to ensure that it collects at least some of the tax you owe in the current tax year.

This is explained in more detail …….

Keeping the books

These days with the plethora of really easy to use systems and Apps available there is no longer any excuses for not keeping on top of your business finances.

It’s about being organised and if that isn’t your strong point then get someone to help you. You need a good accounting system. Your bookkeeping will also be so much easier if you have a dedicated business bank account keeping all your personal costs out of it.

You’ll really crack your bookkeeping if you link your business bank account to your accounting system via bank feeds – this is all explained in ….

Our top tip for saving money – get a Mettle or NatWest business bank account (really easy to apply online) then you will get the award winning best of breed accounting system FreeAgent for free.

More information